40 a bond's coupon rate

Bond Price Calculator Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value. Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly. Market interest rate represents the return rate similar bonds sold on the market can generate. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

A bond's coupon rate

Here's how rising interest rates may affect your bond ... Interest rates are rising in 2022 — here are your best money moves. For example, let's say you have a 10-year $1,000 bond paying a 3% coupon. If market interest rates rise to 4% in one year ... Coupon Rate Definition & Example | InvestingAnswers The coupon rate on the bond is 5%, which means the issuer will pay you 5% interest per year, or $50, on the face value of the bond ($1,000 x 0.05). Even if your bond trades for less than $1,000 (or more than $1,000), the issuer is still responsible for paying the coupon based on the face value of the bond. What is Coupon Rate? Definition of Coupon Rate, Coupon ... Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

A bond's coupon rate. Coupon Rate - Meaning, Calculation and Importance To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders. Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond. For example, if an investor pays less ... What Is Coupon Rate of a Bond | The Fixed Income | Bond ... A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment. What Is Coupon Rate and How Do You Calculate It? Dec 03, 2019 · Bond coupon rate dictates the interest income a bond will pay annually. We explain how to calculate this rate, and how it affects bond prices. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford? Mortgage Calculator Rent vs Buy

Bond Coupon Interest Rate: How It Affects Price A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's... Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment. Coupon Rate of a Bond (Formula, Definition) | Calculate ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, You are free to us... What Is the Coupon Rate of a Bond? Nov 18, 2021 · A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

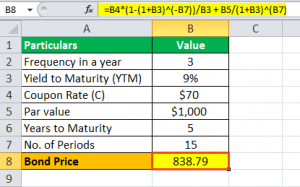

Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 What Is a Coupon Rate? And How Does It Affects the Price ... Every year it pays the holder $50. To calculate the bond coupon rate, total annual payments need to be divided by the bond's par value. Annual payments = $ 50. Coupon rate = $500 / $1,000 = 0.05. The bond's coupon rate is 5 percent. This is the portion of bond that shall be paid every year. United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. Skip to content. Markets ... Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year . 0.13: 103.32- ... Coupon Rate Formula | Calculator (Excel Template) Coupon Rate is calculated by dividing Annual Coupon Payment by Face Value of Bond, the result is expressed in percentage form. The formula for Coupon Rate - Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Below are the steps to calculate the Coupon Rate of a bond:

Coupon Rate of a Bond - Harbourfront Technologies Coupon Rate of a Bond = Total Annual Coupon Payment / Par Value of Bond x 100% For example, a bond offers a total annual coupon payment of $50. The bond's par value is $1,000. Therefore, its coupon rate will be 5% ($50 / $1,000 x 100). What are the uses of Coupon Rates? Almost every bond that investors may obtain will have a coupon payment.

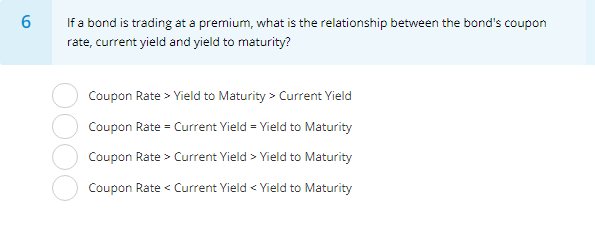

Solved Remember, a bond's coupon rate partially determines ... Remember, a bond's coupon rate partially determines the interest-based return that a bond (will / might) pay, and a bondholder's required return reflects the return that a bondholder (is obligated / would like) to receive from a given investment.. The mathematics of bond valuation imply a predictable relationship between the bond's coupon rate, the bondholder's required return, the ...

Solved Assume there is a bond with the coupon rate of 12.0 ... What is the bond's current market value? O $1,401.25 O $1,399.29 O $1,395.50 O $1,374.54 ; Question: Assume there is a bond with the coupon rate of 12.0%, yield to maturity (YTM) of 6.2%, and with the face value of $1,000. Further assume that the bond will mature 9 years from now, and that the interest rate will compound semiannually.

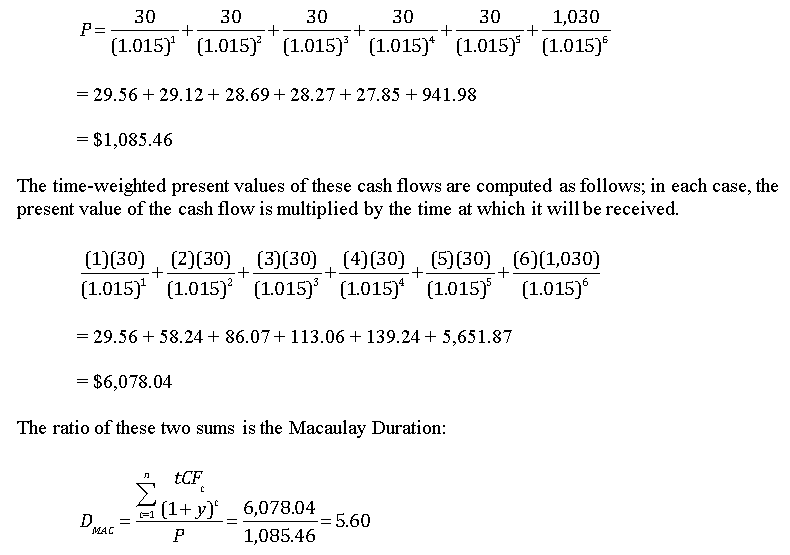

maturity debt funds: Constant maturity debt funds gain in ... When bond yields rise, bond prices fall and the reverse too is true. This is termed interest rate risk. When the duration of a bond's portfolio - a measure of the bond's interest rate risk calculated using maturity, coupon and current yield - is high, the interest rate risk is also high, and vice versa.

Coupon Rate Definition - investopedia.com Sep 05, 2021 · The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it pays total ...

Basics Of Bonds - Maturity, Coupons And Yield A bond's coupon is the annual interest rate paid on the issuer's borrowed money, generally paid out semi-annually on individual bonds. The coupon is always tied to a bond's face or par value and is quoted as a percentage of par. Say you invest $5,000 in a six-year bond paying a coupon rate of five percent per year, semi-annually.

How To Find Coupon Rate Of A Bond On Financial Calculator Coupon Rate = (Coupon Payment / Par Value) x 100 For example, you have a $1,000 par value bond with an annual coupon payment of $50. The bond has 10 years until maturity. Using the formula above, we would calculate the coupon rate as follows: Coupon Rate = ($50 / $1,000) x 100 = 5% Own or Dealer Bid

Coupon Bond Formula | How to Calculate the Price of Coupon ... Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Determine the price of each C bond issued by ABC Ltd. Below is given data for the calculation of the coupon bond of ABC Ltd. Therefore, the price of each bond can be calculated using the below formula as,

What is Coupon Rate? Definition of Coupon Rate, Coupon ... Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

Coupon Rate Definition & Example | InvestingAnswers The coupon rate on the bond is 5%, which means the issuer will pay you 5% interest per year, or $50, on the face value of the bond ($1,000 x 0.05). Even if your bond trades for less than $1,000 (or more than $1,000), the issuer is still responsible for paying the coupon based on the face value of the bond.

Here's how rising interest rates may affect your bond ... Interest rates are rising in 2022 — here are your best money moves. For example, let's say you have a 10-year $1,000 bond paying a 3% coupon. If market interest rates rise to 4% in one year ...

/bond_duration-5bfc37fd46e0fb00260e7d1c.jpg)

Post a Comment for "40 a bond's coupon rate"