38 bond yield vs coupon rate

Yield Vs. Interest Rate: Understanding the Differences ... When you hold bonds, the yield is expressed as yield-to-maturity. This is the total amount you can expect to get from the bond once the bond matures. In this case, the yield will depend on the interest rate you agreed on with the issuer when you bought the bonds. Yield Vs. Interest Rates: The Implications Important Differences Between Coupon and Yield to Maturity The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

Difference Between Yield to Maturity and Coupon Rate ... Summary - Yield to Maturity vs Coupon Rate. Bonds are an attractive investment to equity and are invested in by many investors. While related, the difference between yield to maturity and coupon rate does not depend on each other completely; the current value of the bond, difference between price and face value and time until maturity also affects in varying degrees.

Bond yield vs coupon rate

Difference Between Current Yield and Coupon Rate (With ... The main difference between current yield and coupon rate is that current yield is a ratio of annual income from the bond to the current price of the bond, and it tells about the expected income generated from the bond. In contrast, the coupon rate is a fixed interest paid by the issuer annually on the face value of a bond. Coupon Rate Definition - investopedia.com The coupon rate is the annual income an investor can expect to receive while holding a particular bond. It is fixed when the bond is issued and is calculated by dividing the sum of the annual... Coupon vs Yield | Top 8 Useful Differences (with Infographics) 3. Interest rates influence the coupon rates. The current yield compares the coupon rate to the market price of the bond. 4. The coupon amount remains the same until maturity. Market price keeps on fluctuating, better to buy a bond at a discount which represents a larger share of the purchase price. 5.

Bond yield vs coupon rate. Bond Prices, Rates, and Yields - Fidelity Coupon rate—The higher a bond's coupon rate, or interest payment, the higher its yield. That's because each year the bond will pay a higher percentage of its face value as interest. Price—The higher a bond's price, the lower its yield. That's because an investor buying the bond has to pay more for the same return. Bond Yield Rate Vs. Coupon Rate: What's The Difference? () Bond Yield Rate vs. Coupon Rate: An Overview A bond's coupon fee is the velocity of curiosity it pays yearly, whereas its yield is the velocity of return it generates. A bond's coupon worth is expressed as a proportion of its par price. The par price is solely the face price of the bond… Bond Coupon Difference eteq IoB Rate Whats Yield What Is the Coupon Rate of a Bond? In contrast to the bond's coupon rate, which is a stated interest rate based on the bond's par value, the current yield is a measurement of the dollar amount of interest paid on the bond compared to the price at which the investor purchased the bond. In other words, the current yield is the coupon rate times the current price of the bond. Difference Between Coupon Rate And Yield Of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion

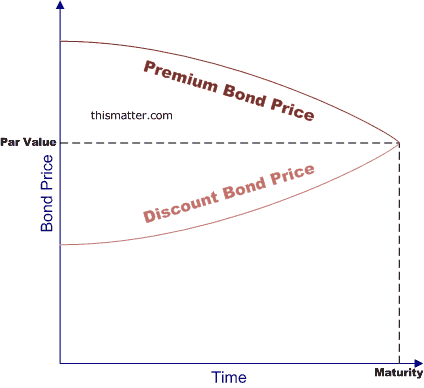

How are bond yields different from coupon rate? | The ... The coupon rate is often different from the yield. A bond's yield is more accurately thought of as the effective rate of return based on the actual market value of the bond. At face value, the ... Bond Yield: Formula and Calculator [Excel Template] Step 2: The annual coupon is a function of the bond's coupon rate, par value, and payment frequency - and, if applicable, the coupon rate must be annualized. Step 3 : The current yield formula equals the annual coupon payment divided by the bond's current market price, expressed as a percentage. Understanding Bond Prices and Yields - Investopedia The same holds true for bonds priced at a discount; they are priced at a discount because the coupon rate on the bond is below current market rates. Yield Tells (Almost) All A yield relates a... Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a percentage of its par value. The par value...

Coupon Rate vs Yield Rate for Bonds - Wall Street Oasis If by Yield you mean Yield to Maturity, then it is the discount rate on the bond's cash flows. Bond Price = NPV of the CF's of the Bond = (Face Value)(Coupon Rate)/(1 + YTM) + (Face Value)(Coupon Rate)/(1 + YTM)^2 + ... + [(Face Value)*(Coupon Rate) + Face Value]/(1 + YTM)^n, where n is maturity for the bond. Since interest rates (discount rates) for each period aren't necessarily the same, if ... Bond Yield Rate Vs Coupon Rate - TiEcon 2018 If the general interest rate is 3% but the coupon is 5%, investors when the market interest rate exceeds the coupon rate, bonds sell for less than face value. rush to purchase the bond, in order to snag a higher investment return. This increased demand causes bond prices to rise until the $1,000 face value bond sells for $1,666. Explaining Yields vs Coupon rate of Bonds - Orb52 ... For example when issuing the bonds, if they are issued at a face value of ₹10,000 and the coupon rate on the bond is 10% then the interest rate that will be paid is ₹1,000. But when the Price of the bond fell to ₹9500, then even in such a situation the interest that will be received is still ₹1,000. Coupon vs Yield | Top 5 Differences (with Infographics) coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held …

Coupon Rate vs Yield for a Bond: Fixed Income 101: Easy ... This video addresses "Coupon Rate vs Yield" for a Bond in a simple, kid-friendly way. PLEASE SUBSCRIBE (It's FREE!): ...

Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Since bonds do not always trade at face value, YTM gives investors a method to calculate the yield they can expect to earn on a bond. Coupon rate is a fixed value in relation to the face value of a bond.

Explain Bonds, Bond Terms, Price and Yield, Types of Bond Risk - Arbor Asset Allocation Model ...

Bond yield vs coupon rate: Why is RBI trying to keep yield ... For example, if the price of the 10-year bond with fave value of Rs 1,000 and coupon rate of 6 per cent falls to Rs 600 in the secondary market, it will still fetch the interest of Rs 60 per year...

Rates & Bonds - Bloomberg Get updated data about global government bonds. Find information on government bonds yields, bond spreads, and interest rates.

Bond Basics: How Interest Rates Affect Bond Yields ... When interest rates rise, prices of existing bonds tend to fall, even though the coupon rates remain constant: Yields go up. Conversely, when interest rates fall, prices of existing bonds tend to rise, their coupon remains constant - and yields go down. Quality matters. Not surprisingly, a bond's quality also has direct bearing on its price ...

Bond Yield Rate vs. Coupon Rate: What's the Difference ... A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity.

Bond Yield Calculator - Compute the Current Yield On this page is a bond yield calculator to calculate the current yield of a bond. Enter the bond's trading price, face or par value, time to maturity, and coupon or stated interest rate to compute a current yield. The tool will also compute yield to maturity, but see the YTM calculator for a better explanation plus the yield to maturity formula.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-02-10d2adc981ea475eb2165a5ec13082ed.jpg)

Post a Comment for "38 bond yield vs coupon rate"