40 treasury bonds coupon rate

Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the coupon rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly. US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

Understanding Treasury Bond Interest Rates - Bankrate.com Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value) that you own. The...

Treasury bonds coupon rate

What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. Treasury Bonds | CBK TWO YEAR FIXED COUPON, TREASURY BOND ISSUE FXD 3/2010/2 DATED SEPTEMBER 27, 2010: 06/08/2010: 9-YEAR GOVERNMENT OF KENYA, INFRASTRUCTURE BOND ISSUE NO. IFB 2/2010/9 DATED AUGUST 30, 2010: ... Find the bond's coupon rate, maturity date and issue date using our Treasury Bonds Results table above. You'll find a full schedule of the bond's ... Important Differences Between Coupon and Yield to Maturity The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

Treasury bonds coupon rate. U.S. Treasury Bond Futures Quotes - CME Group Gain an in-depth view into the US Treasury market, including yields, volatility, auctions, coupon issuance projections, and more. STIR Analytics View historical fixings for EFFR and SOFR, and analyze basis spreads between Eurodollar, Fed Fund, and SOFR futures. Total Cost Analysis U.S. Treasury Confirms I Bonds Will Pay A 9.62% Interest Rate With inflation increasing this year to multi-decade highs, I Bonds bought from May until Monday, October 31, will pay an annualized interest rate of 9.62%. Keep in mind that the 9.62% rate is an ... How Often do Treasury Bonds Pay Interest? - Fox Business A 30-year U.S. Treasury bond falls into that category. The most recently issued 30-year bond has a 2.75% coupon. The coupon rate determines the interest payments. The 2.75% is the annual coupon.... Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers.

Treasury Yield Definition - Investopedia Treasury yield is the effective annual interest rate that the U.S. government pays on one of its debt obligations, expressed as a percentage ... Bond Yield Definition - Investopedia If a bond has a face value of $1,000 and made interest or coupon payments of $100 per year, then its coupon rate is 10% ($100 / $1,000 = 10%). However, ... Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate. Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond...

What Is the Coupon Rate of a Bond? - The Balance ABC bond's coupon rate was 3%, based on a par value of $1,000 for the bond. This translates to $30 of interest paid each year. Let's say Investor 1 purchases the bond for $900 in the secondary market but still receives the same $30 in interest. This translates to a current yield of 3.33%. Solved Treasury bonds pay coupon interest semiannually. | Chegg.com Treasury bonds pay coupon interest semiannually. Suppose the annual coupon rate is 7%, the face value is $1,000, and the annual yield to maturity (R) is 8% with a maturity of 1 year. What is the security's duration? a.1.78 b.1.95 c.0.55 d.0.98 e.2.22 Expert Answer Semi-annual coupon payment =$1000*7%*6/12 =$35 Coupon Payment Cash Flow … PDF Changes in Treasury Bonds Coupon Rates Coupon Rate 2-year 7.60% 5-year 8.60% 7-year 9.48% 10-year 10.25% 15-year 11.15% 20-year 12.10% 25-year 12.56% The rates shall be applicable prospectively from 13thApril 2022 and do not affect the previously issued Treasury bonds. The coupons are fixed for the duration of the bond and shall be paid semiannually. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

Individual - Series I Savings Bonds - TreasuryDirect Rates & Terms. I bonds have an annual interest rate derived from a fixed rate and a semiannual inflation rate. Interest, if any, is added to the bond monthly and is paid when you cash the bond. I bonds are sold at face value; i.e., you pay $50 for a $50 bond. More about I bond rates; Redemption Information. Minimum term of ownership: 1 year

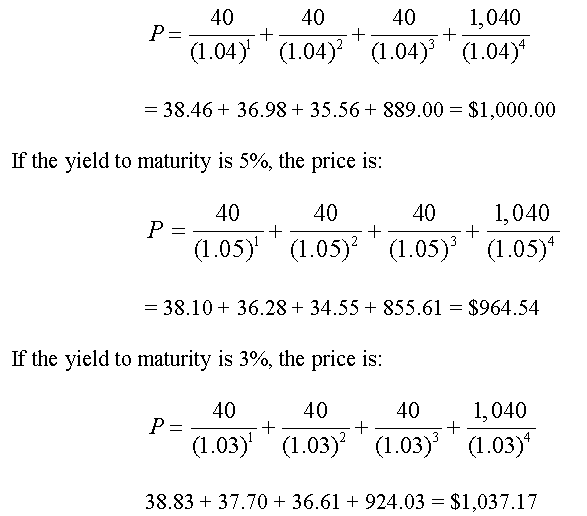

Institutional - Treasury Bonds Treasury Bonds. Treasury bonds are interest-bearing securities with maturities over 10 years. Treasury bonds pay interest on a semi-annual basis. When a bond matures, the investor receives the face value. Price vs. Yield to Maturity. The price of a fixed rate security depends on the relationship between its yield to maturity and the interest rate.

United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Treasury Yields. Name Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month .

Coupon Rate Calculator | Bond Coupon coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! What is the difference between bond coupon rate and yield to maturity (YTM)?

Treasury Bond (T-Bond) Definition - Investopedia A treasury bond is a marketable, fixed-interest U.S. government debt security with a maturity of more than 10 years and which pays periodic interest ...

Coupon Rate Definition - Investopedia Sep 05, 2021 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

How Is the Interest Rate on a Treasury Bond Determined? A Treasury bond pays a "coupon rate." This is the percentage return paid to the investor periodically until its maturity date. Treasury bonds also are traded in the market. As fewer payments remain...

Coupon Interest and Yield for eTBs - Australian Government ... The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months.

Post a Comment for "40 treasury bonds coupon rate"