41 zero coupon bond value calculator

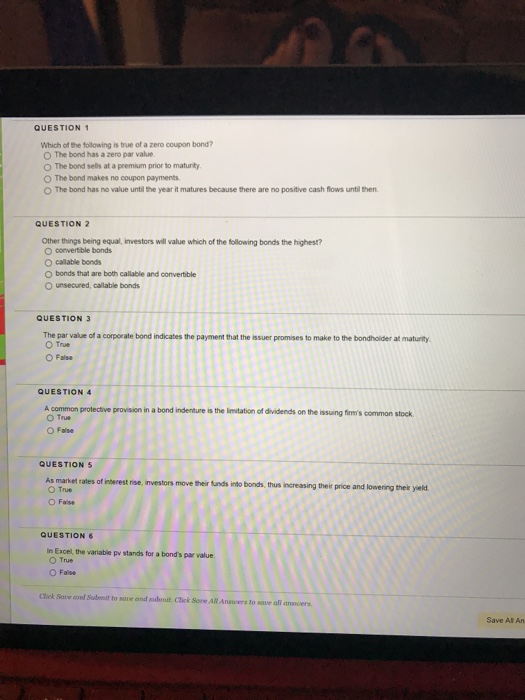

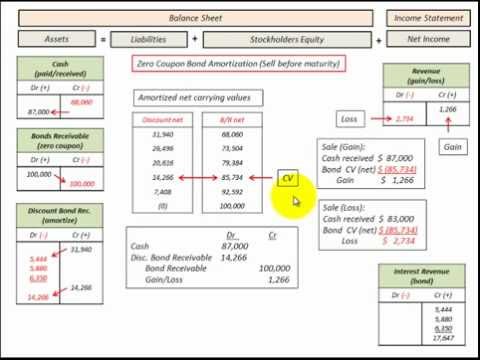

Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

How to Calculate Yield to Maturity of a Zero-Coupon Bond Zero-Coupon Bond YTM Example Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula...

Zero coupon bond value calculator

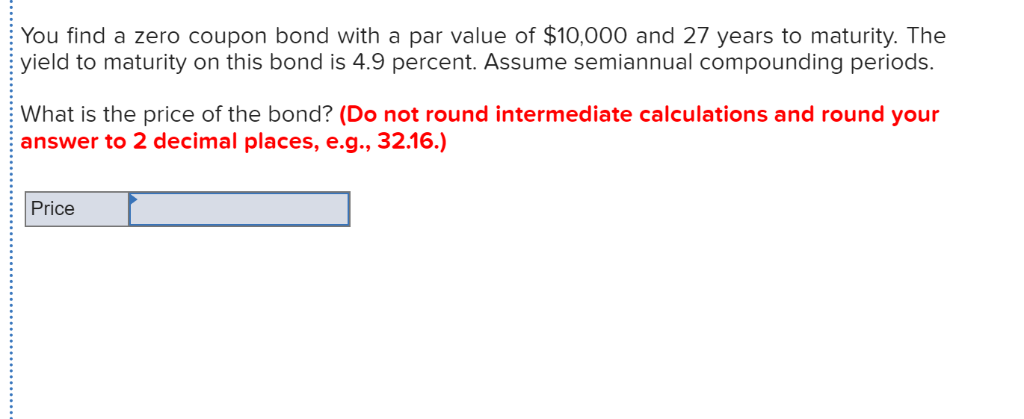

Zero-Coupon Bond Definition - Investopedia Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Zero Coupon Bond Value Calculator - buyupside.com Zero Coupon Bond Value Calculator Compute the value (price) of a zero coupon bond. The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield / 2) ** Years to Maturity * 2 Related Calculators Bond Convexity Calculator Zero Coupon Bond Calculator Zero Coupon Bond Formula The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t where ZCBV is the zero-coupon bond value F is the face value of the bond r is the yield/rate t is the time to maturity Zero Coupon Bond Definition

Zero coupon bond value calculator. Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity. Zero Coupon Bond Calculator | Huntington Zero Coupon Bond Calculator | Huntington Should I buy a zero coupon bond? We are here to help. If you can't find what you're looking for, let us know. We're ready to help in person, online or on the phone. Call Us To speak to a customer service representative, call (800) 480-2265. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Example Zero-coupon Bond Formula P = M / (1+r)n variable definitions: P = price M = maturity value r = annual yield divided by 2 n = years until maturity times 2 The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

Zero Coupon Bond Calculator - MiniWebtool The Zero Coupon Bond Calculator is used to calculate the zero-coupon bond value. Zero Coupon Bond Definition A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments. When the bond reaches maturity, its investor receives its face value. Zero-Coupon Bond Value Calculator - MYMATHTABLES.COM Zero-Coupon Bond Value Calculator This online calculator is used to calculate the zero-coupon bond price, yield to maturity and spending power at maturity. Face value at maturity ($) Interest rate (APR %) Years to maturity Months to maturity Annual inflation rate (%) Marginal income tax rate (%) Results... Zero Coupon Bond Price = $914.54 Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =. Zero Coupon Bond Yield - Formula (with Calculator) The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) Price of a Zero coupon bond - Calculator - Finance pointers The Price of a zero coupon bond is calculated using the following formula : = FV / ( 1 + r ) n. Where. P = Price of a zero coupon bond ; FV = Face value / Maturity value of the zero coupon bond ; r = Discount rate ; n = Term to maturity ; In the calculator below insert the values of Face value / Maturity value of the zero coupon bond, Discount ... Zero Coupon Bond Value Calculator - Find Formula, Example & more Zero Coupon Bond Value = Face Value of Bond / (1 + Rate of Yield) ^ Time of Maturity Following which the workout will be: Zero Coupon Bond Value = 1000 / (1 + 6) ^ 5 When we solve the equation barely by hand or use the calculator we put up, the product will be Rs.747.26. Zero Coupon Bond Calculator - What is the Market Value? Zero Coupon Bond Calculator Inputs Bond Face Value/Par Value ($) - The face or par value of the bond - essentially, the value of the bond on its maturity date. Annual Interest Rate (%) - The interest rate paid on the zero coupon bond. Years to Maturity - The numbers of years until the zero coupon bond's maturity date.

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond.

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is Price = M / (1+r)n where: M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity 3.

Calculate the Value of a Zero-coupon Bond - Finance Train Calculate the Value of a Zero-coupon Bond Suppose you have a pure discount bond that will pay $1,000 five years from today. The bond discount rate is 12%. What is the appropriate price for this bond? Since there are no interim coupon payments, the value of the bond will simply be the present value of single payment at maturity. Checkout our eBooks

Zero Coupon Bond Calculator - Tool Slick Example. Let's consider $1,000 zero coupon bond that has 2 years until maturity. The bond is currently valued at $925 (the price it could be purchased at today). The formula would look like: (1000 / 925) ^ (1 / 2) - 1. When solved according to the above formula, this equation produces a value of 0.03975, or 3.98%.

Coupon Rate Calculator | Bond Coupon And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find ...

Zero Coupon Bond Value Calculator - StableBread Bond Pricing Calculator: Clean/Flat Price, Dirty/Market Price, and Accrued Interest. Credit Spread Calculator. Current Yield Calculator. Tax-Equivalent Yield (TEY) Calculator. Yield to Call (YTC) Calculator. Yield to Maturity (YTM) Calculator. Zero Coupon Bond Effective Yield Calculator.

Zero Coupon Bond Value Formula: How to Calculate Value of Zero Coupon Example of YTM of a zero-coupon bond calculation Let's assume an investor wants to buy a zero-coupon bond and wants to evaluate what YTM of this bond would be. The face value of the bond is $10,000. The price of the bond is $9,100. There are 2 years until maturity. katex is not defined YTM of this bond is 4.83%.

Bond Price Calculator | Formula | Chart The bond valuation calculator follows the steps below: Determine the face value. The face value is the balloon payment a bond investor will receive when the bond matures. For our example it is face = $1,000. Calculate the coupon per period. To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency.

Zero Coupon Bond Calculator Zero Coupon Bond Formula The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t where ZCBV is the zero-coupon bond value F is the face value of the bond r is the yield/rate t is the time to maturity Zero Coupon Bond Definition

![[最も人気のある!] yield to maturity formula zero coupon bond 161022-Yield to ...](https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/3c6e5bb50cc52661a60765809cfac037/thumb_1200_1553.png)

Post a Comment for "41 zero coupon bond value calculator"