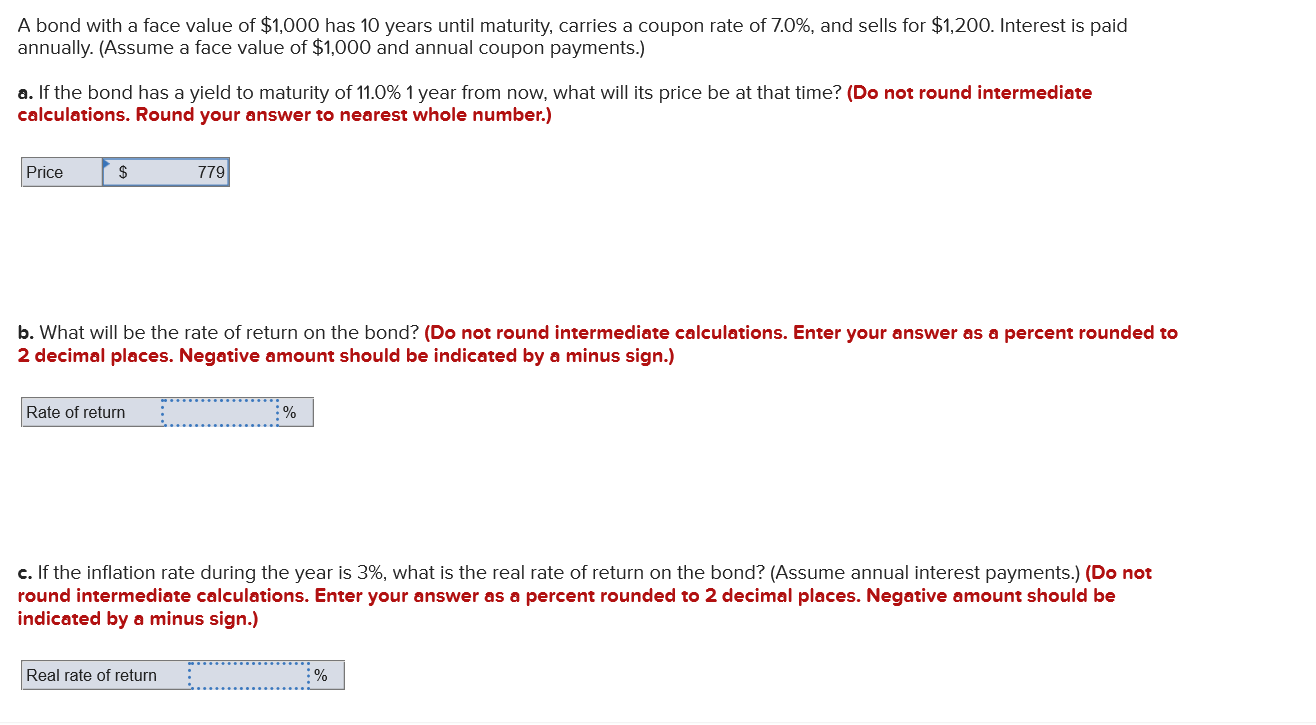

45 what are coupon payments

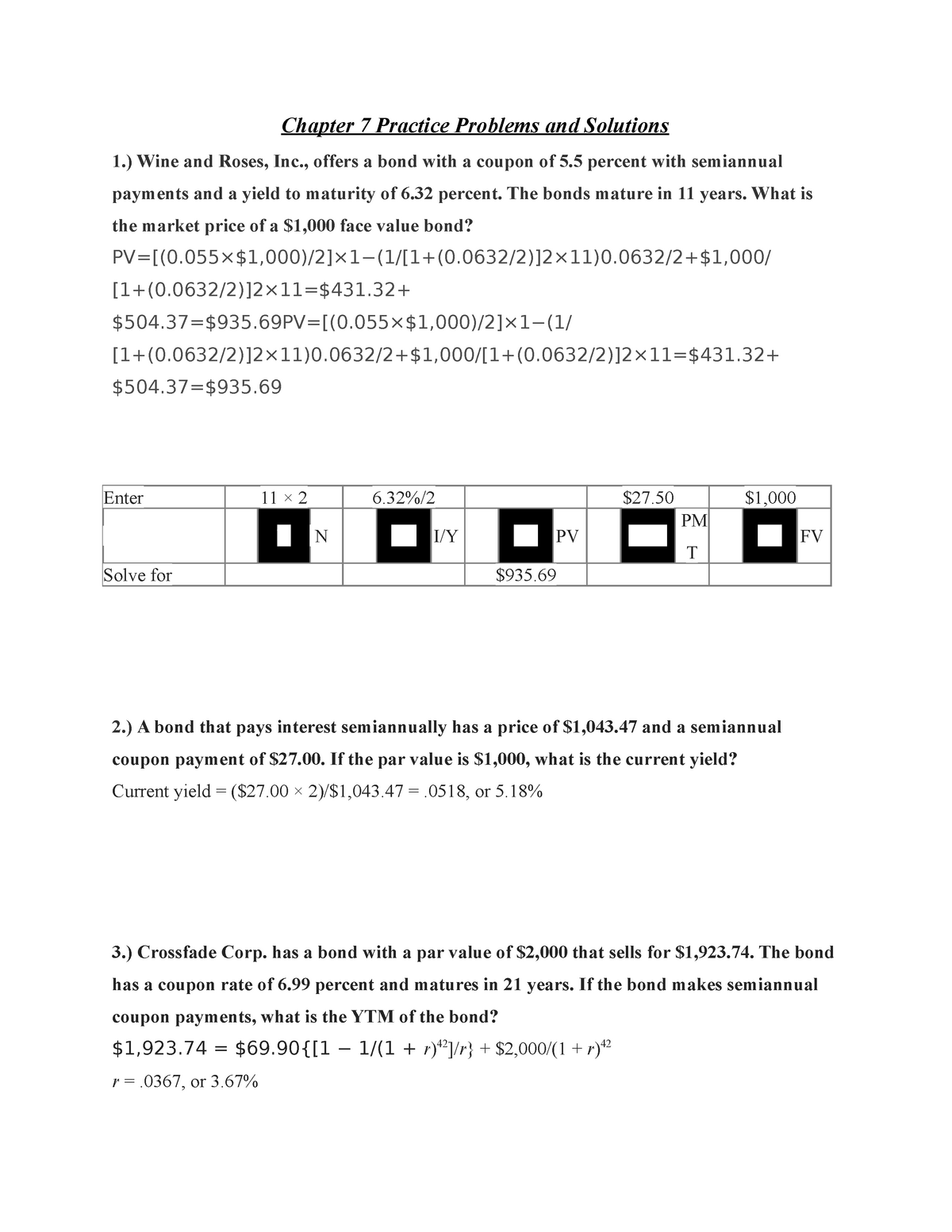

Coupon Rate Formula | Step by Step Calculation (with Examples) Annual Coupon Payment Annual coupon payment = 4 * Quarterly coupon payment = 4 * $25 = $100 Therefore, the coupon rate of the bond can be calculated using the above formula as, Coupon Rate of the Bond will be - Therefore, Dave is correct. Payment Coupon Templates - 11+ Free Printable PDF Documents Download ... A payment coupon template was designed to help you help customers make payments at the counter in a personalized way. The coupon template is only used at an instance where you want your customers to purchase available items at discount prices. Designed for all types of businesses, this could perhaps be the best tool your business needs to ...

UBS declares coupon payments on 5 ETRACS Exchange Traded Notes CEFD and MVRL pay a variable monthly coupon linked to 1.5 times the cash distributions, if any, on the respective underlying index constituents, less withholding taxes, if any.

What are coupon payments

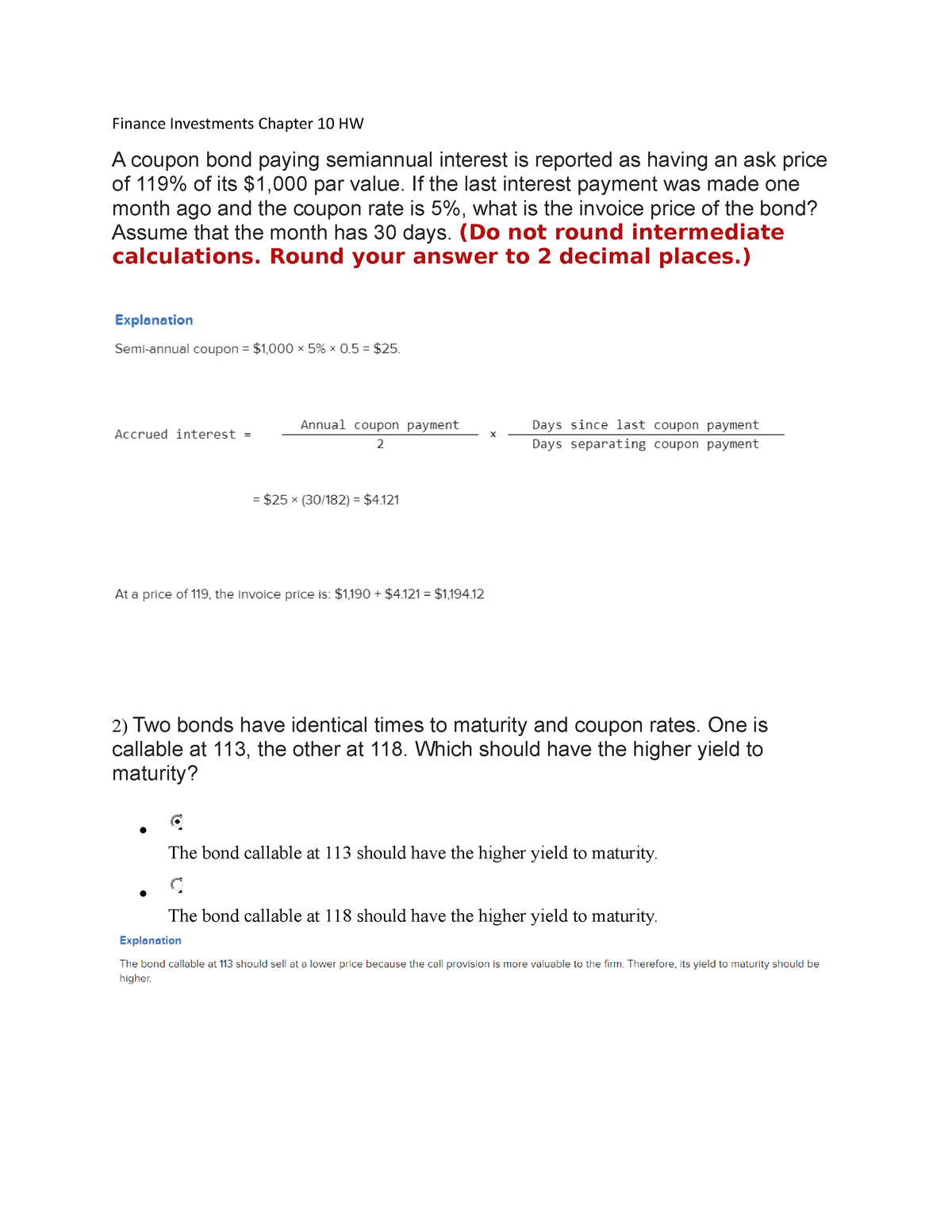

Coupon Payment Calculator The coupon payment is the interest paid by a bond issuer to a bondholder at each payment period until the bond matures or it is called. The payment schedule can be quarterly, semiannually or annually, depending on the agreed time. When a bond is first issued, the bond's price is its face value. Credit Suisse Announces Coupon Payments and Expected Coupon Payments on ... Coupon payments for the ETNs (if any) are variable and do not represent fixed, periodic interest payments. The Expected Coupon Amount for any ETN may vary significantly from coupon period to coupon period and may be zero. Accordingly, the Expected Current Yield will change over time, and such change may be significant. ... Credit Suisse Announces Coupon Payments and Expected Coupon Payments on ... Coupon payments for the ETNs (if any) are variable and do not represent fixed, periodic interest payments. The Expected Coupon Amount for any ETN may vary significantly from coupon period to ...

What are coupon payments. What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities. Coupon Payment | Definition, Formula, Calculator & Example A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments. Credit Suisse Announces Coupon Payments and Expected Coupon Payments on ... Coupon payments on the ETNs will vary and could be zero. There is no actual portfolio of assets in which any investor in the ETNs has any ownership or other interest. Investors in the ETNs do not ... Add discounts for one-time payments | Stripe Documentation The coupon object adds discounts to both one-time payments and subscriptions. Some coupon object parameters, like duration, only apply to subscriptions. Limit redemption usage. The max_redemptions and redeem_by values apply to the coupon across every application. For example, you can restrict a coupon to the first 50 usages of it, or you can make a coupon …

Images Definition: A coupon payment is the annual interest payment paid to a bondholder by the bond issuer until the debt instrument matures. State of Oregon: Payroll Taxes - Tax Payments If you’re making ACH credit payments, you’ll need to fill out a short application to get the information your financial institution needs to initiate the payment. With a Revenue Online account, withholding taxpayers can generate their Form OR-OTC-V , Oregon Combined Payroll Tax Payment Voucher . Coupon Rate Calculator | Bond Coupon A coupon is the interest payment of a bond. Typically, it is distributed annually or semi-annually depending on the bond. We usually calculate it as the product of the coupon rate and the face value of the bond. How often do I receive coupons from investing in bonds? The short answer is it depends on the bonds that you invest in. What is a Coupon Payment? - Definition | Meaning | Example What is the definition of coupon payment? Coupon payments are vital incentives to investors who are attracted to lower risk investments. These payments get their name from previous generations of bonds that had a physical, tear off coupon that investors had to physically hand in to the issuer as evidence that they owned the bond.

Coupon Bond - Investopedia A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments. With coupon bonds, there are no records of... How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow Since bondholders generally receive their coupon payments semiannually, you just divide the annual coupon payment by two to receive the actual coupon payment. For example, if the annual coupon payment is $80, then the actual coupon payment is $80/2 or $40. Tips The calculations above will work equally well when expressed in other currencies. Payment Coupon Books, Payment Books - Bank-A-Count.com Payment coupon books are the easy way to collect payment from your customers. Books have a variety of features and can be customized to suit your individual needs. Choose from custom inserts, coupon formats, and more! All Bank-A-Count products are backed by an outstanding customer service team. Payment books feature: Affordable, competitive pricing UBS Declares Coupon Payments on 12 ETRACS Exchange Traded ... Oct 06, 2022 · The Current Yield is not indicative of future coupon payments, if any, on the ETN. You are not guaranteed any coupon or distribution amount under the ETN. Note: HDLB, SMHB and PFFL pay a variable monthly coupon linked to 2 times the cash distributions, if any, on the respective underlying index constituents, less withholding taxes, if any.

UBS declares quarterly coupon payments on Exchange Traded ... Aug 19, 2022 · The Current Yield is not indicative of future coupon payments, if any, on the ETN. You are not guaranteed any coupon or distribution amount under the ETN.

login Please be vigilant in protecting yourself against phishing. Keeping your personal information secure is a top priority of MetLife. That's why we encourage you to take precautions to protect your personal data, and why we do not ask you to verify your personal or account information by email or text message.

Coupon Payment - Investor.gov Coupon Payment The dollar amount of interest paid to an investor. The amount is calculated by multiplying the interest of the bond by its face value.

Zero-Coupon Bond - Definition, How It Works, Formula Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year.

How to Calculate a Coupon Payment | Sapling In finance, a coupon payment represents the interest that's paid on a fixed-income security such as a bond. Par value is the face value of a bond. Calculate the annual coupon rate by figuring the annual coupon payment, dividing this amount by the par value and multiplying by 100 percent.

Buying a $1,000 Bond With a Coupon of 10% - Investopedia Sep 09, 2022 · Fixed-rate corporate or government bonds pay regular interest payments to bondholders. These bonds typically pay out a semi-annual coupon. Owning a 10% ten-year bond with a face value of $1,000 ...

Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions Bond Coupon Payments. A bond's coupon is the annual interest rate paid on the issuer's borrowed money, generally paid out semi-annually on individual bonds. The coupon is always tied to a bond's face or par value and is quoted as a percentage of par.

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value .

Coupon Rate of a Bond - WallStreetMojo Coupon Rate is referred to the stated rate of interest on fixed income securities such as bonds. In other words, it is the rate of interest that the bond issuers pay to the bondholders for their investment. It is the periodic rate of interest paid on the bond's face value to its purchasers.

Russia makes Eurobond coupon payments in FX - Reuters Russia is due to pay coupons on Eurobonds maturing in 2027, 2028 and 2048 in late June.

Credit Suisse Announces Coupon Payments and Expected Coupon ... Jul 07, 2022 · Coupon payments for the ETNs (if any) are variable and do not represent fixed, periodic interest payments. The Expected Coupon Amount for any ETN may vary significantly from coupon period to ...

UBS Declares Coupon Payments on 12 ETRACS Exchange Traded Notes CEFD and MVRL pay a variable monthly coupon, and MLPR and BDCX pay a variable quarterly coupon, each linked to 1.5 times the cash distributions, if any, on the respective underlying index ...

Coupon legal definition of Coupon - TheFreeDictionary.com coupon: A certificate evidencing the obligation to pay an installment of interest or a dividend that must be cut and presented to its issuer for payment when it is due. Coupons are usually attached to a document, such as a promissory note, bond, share of stock, or a bearer instrument. A coupon is a written contract for the payment of a ...

Coupon Definition - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms...

What is Coupon payment | Capital.com It's the annual interest payment made by the issuer of a bond to the bondholder until it reaches maturity. The coupon payment - or simply coupon is expressed as a percentage of the bond's value at the time it was issued. Where have you heard about coupon payment? The term coupon comes from once popular bearer bond certificates.

What Is a Coupon Payment? - Smart Capital Mind A coupon payment is a payment made to the holder of a bond for the interest that bond accrues while it is maturing. This is typically made as a semi-annual payment, so only half of the interest owed on the bond is paid at a time.

What Are Coupon Payments? - ClydeBank Media Coupon payment is the periodic payment of interest by a bond issuer to a bondholder. Coupon payment is not to be confused with stock dividend payment—the ...

EQS-News: Polyus Finance Plc: Update on coupon payments in ... Sep 22, 2022 · Update on coupon payments in respect of 2023 Eurobonds. Under the terms of the Notes the Issuer was instructed to transfer the funds to the account of i2 Capital Trust Corporation Ltd, acting as a ...

Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance.

Loan Calculator Coupon interest payments occur at predetermined intervals, usually annually or semi-annually. Zero-coupon bonds do not pay interest directly. Instead, borrowers sell bonds at a deep discount to their face value, then pay the face value when the bond matures. Users should note that the calculator above runs calculations for zero-coupon bonds.

Coupon payments financial definition of Coupon payments Coupon payments are expressed as a percentage of the face value ( par) of a bond. For example, if one holds a bond worth $100,000 at 5% interest, the bondholder will receive $5,000 in coupon payments per year (or, more strictly, $2,500 every six months) until the bond matures or he/she sells the bond.

Credit Suisse Announces Coupon Payments and Expected Coupon Payments on ... Coupon payments for the ETNs (if any) are variable and do not represent fixed, periodic interest payments. The Expected Coupon Amount for any ETN may vary significantly from coupon period to ...

Credit Suisse Announces Coupon Payments and Expected Coupon Payments on ... Coupon payments for the ETNs (if any) are variable and do not represent fixed, periodic interest payments. The Expected Coupon Amount for any ETN may vary significantly from coupon period to coupon period and may be zero. Accordingly, the Expected Current Yield will change over time, and such change may be significant. ...

Coupon Payment Calculator The coupon payment is the interest paid by a bond issuer to a bondholder at each payment period until the bond matures or it is called. The payment schedule can be quarterly, semiannually or annually, depending on the agreed time. When a bond is first issued, the bond's price is its face value.

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "45 what are coupon payments"